Blog

A Practical Guide to Managing Family Finances

Managing family finances involves setting clear financial goals, creating and sticking to a budget, building an emergency fund, managing debt and planning for the long term, such as retirement and your children’s education. Involving all family members in the process promotes transparency and responsibility.

Creating a Functional Monthly Spending Plan

A spending plan is your financial GPS. It tells every dollar where to go instead of letting it wander off. Start by mapping all reliable income, whether it is from full time work, freelancing or side gigs. Then list every fixed cost: rent, utilities and that streaming service you forgot to cancel. Group them into essentials, flexible spending and savings.

Foundational steps

- Set financial goals: Define both short term goals (a vacation) and long term goals (retirement or buying a home). Using the S.M.A.R.T. (Specific, Measurable, Achievable, Relevant and Time bound) framework can help make goals more concrete.

- Track income and expenses: To understand your financial health, document all sources of income and categorize your expenses into fix and variable costs. This reveals where your money is going and where you might be overspending.

- Create a realistic budget: A budget should cover your essential needs while allowing for savings and some discretionary spending. Consider the 50/30/20 rule as a guideline, which allocates 50% of after tax income to needs, 30% to wants and 20% to savings and debt repayment. Alternatively, the 70/10/10/10 rule suggests 70% for living expenses, 10% for savings, 10% for investments, and 10% for debt repayment.

- Build an emergency fund: Aim to save at least three to six months’ worth of living expenses in an easily accessible, separate account. This fund provides a financial safety net for unexpected events like job loss or medical emergencies.

- Prioritize debt repayment: If you have high interest debt, create a plan to pay it down strategically. Focus on high interest debts first to save money in the long run. Debt consolidation may be a viable option for simplifying payments and potentially lowering interest rates.

Family collaboration and education

- Involve the family: Hold regular family meetings to discuss the budget and financial goals. This keeps everyone informed and invest in the family’s financial success.

- Teach financial literacy: Instill good financial habits in children by teaching them about saving, budgeting, and responsible spending from a young age. Encourage them to save for their own small goals with a piggy bank or savings account.

- Differentiate needs vs. wants: Clearly distinguish between essential expenses (needs) and non-essential ones (wants). This helps with prioritization and identifying areas to cut costs without sacrificing well-being.

Long term planning

- Plan for retirement and education: Start saving early for your own retirement and your children’s education. Take advantage of tax-advantaged accounts like 401(k)s, IRAs, and 529 plans.

- Consider insurance: Ensure your family is protected from unforeseen events with adequate life, income protection and trauma insurance.

- Create an estate plan: Even for younger families, having a will is important to outline your wishes regarding assets and the guardianship of minor children.

Tools and flexibility

- Use technology: Utilize budgeting apps and spreadsheets to track spending and manage different savings pots.

- Review and adjust regularly: Your financial situation will change over time. Be prepared to review and adjust your budget and goals to reflect new circumstances like changes in income, family size or unexpected expenses.

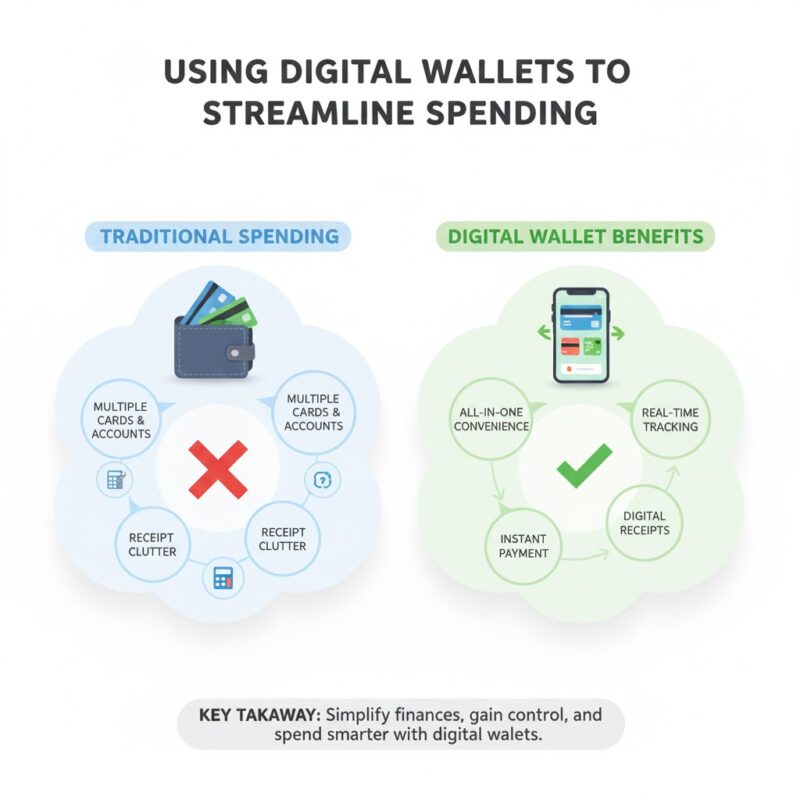

Using Digital Wallets to Streamline Spending

Digital wallets have become a practical tool for modern family budgeting. They do more than just hold virtual cards. They help you manage and monitor daily spending in real time. Families using banking tools like NinjaCard, which can be added to Apple Pay or Google Pay, gain the convenience of mobile payments while keeping everything linked to one secure account.

Creating a family hub for finances

Instead of using separate bank accounts, families can leverage a single digital wallet to manage their shared expenses. This creates a centralized, real time overview of spending, eliminating the guesswork of who paid for what.

- Shared wallets for joint expenses: Many financial apps allow couples to create a joint digital wallet for shared expenses, such as groceries, rent and household bills. This makes it simple to see where money is going and ensure that contributions are fair. For example, some apps let partners split costs 50/50 or by income percentage, maintaining clarity and preventing misunderstandings.

- Family sub accounts with limits: Parents can create sub accounts for their children, where funds can be load for allowances or specific purposes like school lunches. These accounts can be linked to a physical or virtual debit card, giving children practical experience with managing money.

- Control and oversight for parents: With family focus digital wallets, parents can set spending limits, restrict certain merchants, and receive real time notifications for every transaction. This provides peace of mind and makes it easy to monitor children’s spending habits.

Managing Shared Expenses Between Partners

Money disagreements can sneak into even the happiest households. The fix is not in the math it is in the communication. Decide early what counts as a shared expense. Rent, groceries, childcare and insurance are common candidates. Whether you split 50/50 or by income percentage, transparency keeps things calm.

- A joint account or shared expense app helps both partners see where money goes. Schedule a short “budget talk” once a month to review who pays what and to adjust for job or income changes.

- The goal is not to nitpick but to stay aligned. When handled right, shared finances become a symbol of teamwork, not tension.

Strategies for Reducing Existing Debt

Start by facing the numbers. Write down every loan and card balance, then target the ones costing you the most in interest. Pay a little extra where it hurts most and automate the process so consistency does the heavy lifting.

- How it works: Make minimum payments on all your debts, then use any extra money to pay down the one with the highest interest rate. Once that debt is cleared, apply that entire payment amount to the debt with the next highest interest rate and so on.

- Best for: Individuals who are driven by logic and want to save the most money on interest charges in the long run.

- Pros: Financially the most efficient method, as it minimizes the total amount of interest you pay over the life of your debt.

- Cons: It can take a long time to see the first debt paid off, which can be demotivating if your highest interest debt is also your largest.

Controlling New Debt While Managing the Budget

The trick is not cutting all fun but knowing when to press pause. Track where your money actually goes and resist piling on big buys in the same month. Keep credit card balances at levels you can clear quickly interest should never outlive the purchase.

- If multiple bills have you spinning plates, debt consolidation can be a breather, but only if it fits your long game.

- Fewer debts mean less stress, and that breathing room becomes the foundation for real financial growth.

Planning Ahead for Annual or Irregular Costs

Not all costs appear monthly. Holidays, school enrollment fees and car renewals come around less often but still hit hard. Break these large costs into monthly micro savings. if back to school usually costs $600, set aside $50 each month starting in January.

1. Conduct a “financial autopsy”

Go through your last 12 to 24 months of bank statements, credit card bills and receipts to unearth any one time or annual expenses. Common examples include

- Life events: Wedding gifts, baby showers or funeral travel.

- Annual costs: Car registration, insurance premiums or tax payments.

- Seasonal fluctuations: Higher utility bills in summer or winter.

- Household emergencies: Appliance replacements or home repairs.

- Personal expenses: Dental or vision bills.

2. Implement the “sinking fund” method

Instead of a single “irregular expenses” jar, set up specific “sinking funds” for each known annual or irregular cost.

- Use separate accounts: Many modern banks and fintech apps allow you to create sub accounts or “pots” within your main savings account. You can nickname each one (“Holiday Savings,” “Car Fund,” “Back to School”) for clear organization.

- Automate your savings: Set up automatic transfers to move a predetermined amount of money into each fund every payday. If a new car registration costs $600 and is due in six months, you can set up a transfer of $100 per month. This makes saving consistent and effortless.

- Optimize with a high yield account: Keep your sinking funds in a high yield savings account to earn interest on the money until you need it. This helps your money work for you while you wait for the expense to arrive.

3. Common irregular expenses may include

- School supplies and uniforms,

- Holiday gifts and travel,

- Annual insurance premiums,

- Car registration or maintenance,

- Family birthdays or events,

Teaching Kids Basic Budgeting Early On

Children learn financial habits from their parents. Involving them in simple money decisions, like comparing prices or saving for a toy, can build confidence. When children learn to save for something they want, the satisfaction is a lesson that lasts a lifetime.

Bringing Everything Together With Consistency

Family finance is not about flawless tracking or spreadsheets. It’s about consistency, teamwork and small smart moves that compound over time. Set your plan, review it monthly and let technology do the heavy lifting.

Final Word

The best family plan is not perfect it is the one you will actually repeat. Use this A Practical Guide to Managing Family Finances to set clear goals, run a simple budget and meet briefly each month. Keep the Yes List alive so the plan has heart, not just math. Do this and money becomes background music steady, supportive and never too loud.